Life Insurance in and around Wheat Ridge

Protection for those you care about

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

It's Time To Think Life Insurance

If you are young and newly married, it's the perfect time to talk with State Farm Agent Vance Yoshikawa about life insurance. That's because once you start building a life, you'll want to be ready if your days are cut short.

Protection for those you care about

Don't delay your search for Life insurance

State Farm Can Help You Rest Easy

Coverage from State Farm helps you rest easy knowing those you love will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the cost associated with meeting the needs of children, life insurance is an extreme necessity for young families. Even if you're a stay-at-home parent, the costs of replacing daycare or before and after school care can be sizeable. For those who aren't parents, you may be financially responsible to business partners or have other family members whom you help financially.

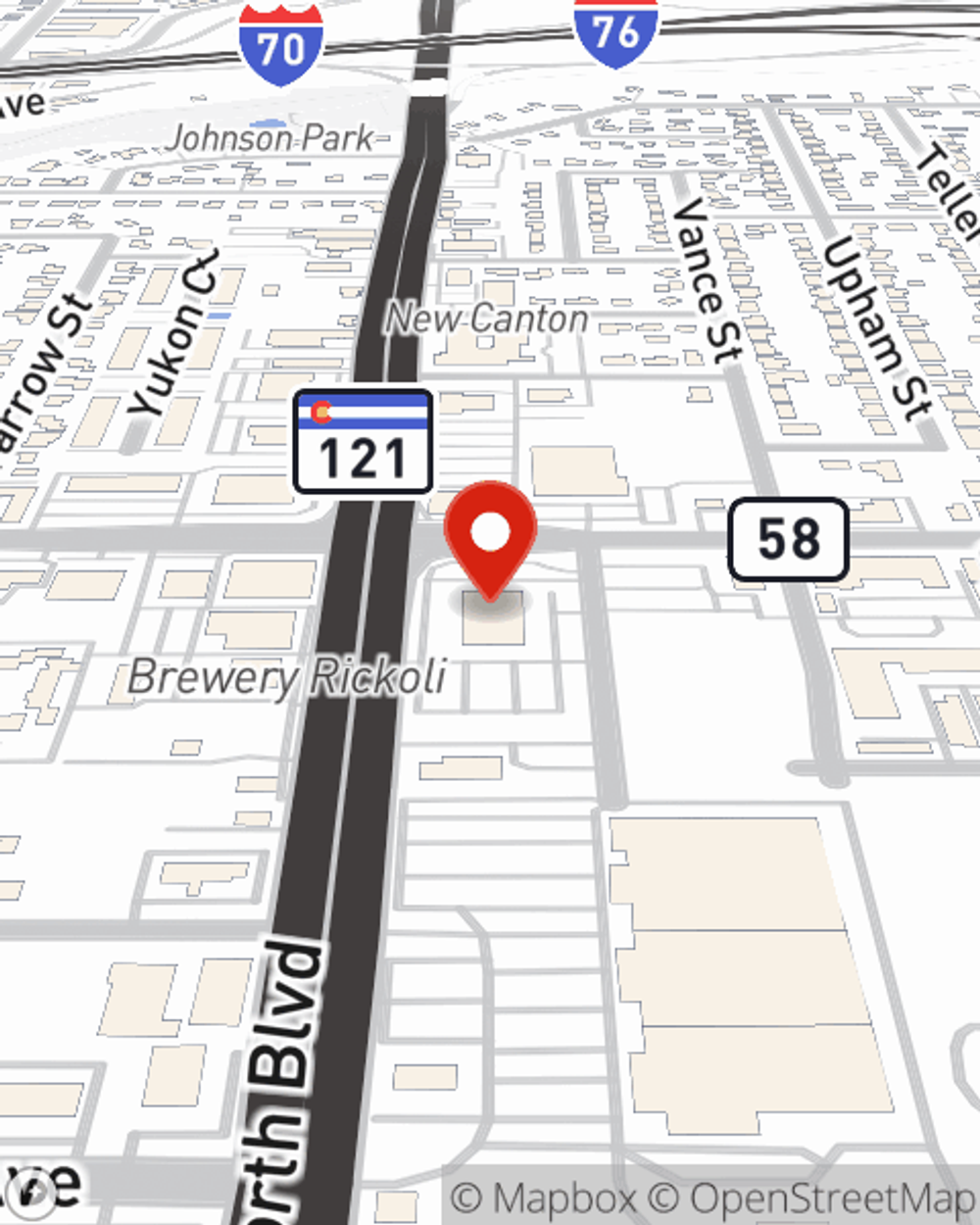

If you're a person, life insurance is for you. Agent Vance Yoshikawa would love to help you check out the variety of coverage options that State Farm offers and help you get a policy that's right for you and the ones you love most. Visit Vance Yoshikawa's office to get started.

Have More Questions About Life Insurance?

Call Vance at (303) 421-6888 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

Vance Yoshikawa

State Farm® Insurance AgentSimple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®